Why YOU Need To Join The Club ?

You don't know, What you don't know....Become Familiar With Asset Classes

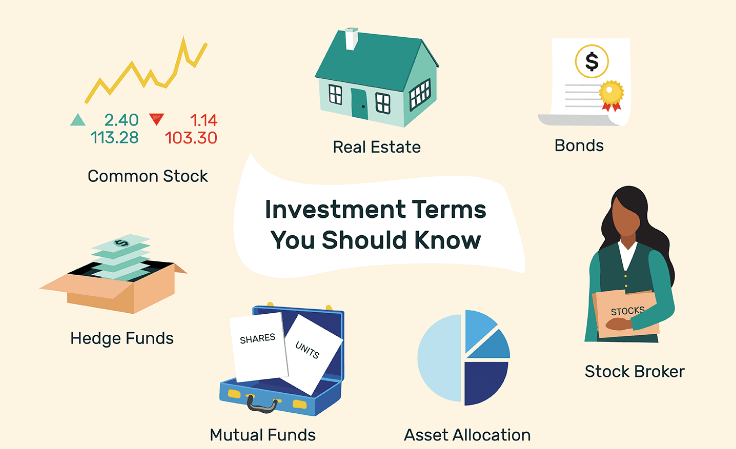

Ever wonder where to start with investing?

Understanding asset classes is key! These are categories of investments that share similar characteristics and behave in similar ways.

Here’s a quick rundown to get you started:

-

Stocks (Equities): Ownership shares in companies, offering potential for capital growth through rising stock prices and dividend payouts.

-

Bonds (Fixed Income): Loans you make to companies or governments, providing regular interest payments and returning your principal at maturity.

-

Cash & Cash Equivalents: Low-risk holdings like savings accounts and money market funds, offering easy access to your money but typically lower returns.

-

Real Estate: Owning physical property like land, buildings, or investment trusts, offering potential for rental income and long-term appreciation.

-

Commodities: Basic materials like oil, gold, or wheat, often traded on futures contracts, and known for their price volatility.

-

Alternative Investments: A broad category including hedge funds, private equity, and venture capital, offering potentially high returns but also carrying a higher degree of risk and often requiring a larger minimum investment.

Active vs. Passive Investing

Active investing and passive investing offer distinct advantages for investors:

-

Active Investing:

-

Potentially outperform the market: Skilled investors can potentially identify undervalued assets and outperform the overall market.

-

Greater control: Actively managed funds allow you to tailor your portfolio to specific goals or risk tolerances.

-

Diversification across asset classes: Active managers can invest in a wider range of assets beyond just stocks, like bonds or real estate.

-

-

Passive Investing:

-

Lower costs: Passively managed index funds typically have lower fees compared to actively managed funds.

-

Less time commitment: Requires minimal research and portfolio management, ideal for busy schedules.

-

Consistent returns: Tracks the performance of a market index, offering predictable long-term growth.

-

Become Financially Savvy

Becoming financially savvy is all about taking control of your money and building a secure future.

Here’s how:

-

Track your spending: Understand where your money goes by creating a budget and using budgeting apps.

-

Pay off debt: Prioritize eliminating high-interest debt to free up cash for savings and goals.

-

Automate your finances: Set up automatic transfers to savings and bill payments to stay on track.

-

Build an emergency fund: Aim for 3-6 months of living expenses to weather unexpected costs.

-

Invest for the future: Start small, research different investment options, and consider seeking professional financial advice.

-

Learn continuously: Read books, listen to podcasts, and attend workshops to expand your financial knowledge.